PUBLIC DEBT BURDEN AND FISCAL SUSTAINABILITY IN THE CARIBBEAN REGION

The focal point of this article draws reference to the Study – “Debt Burden and Fiscal Sustainability in the Caribbean Region,” conducted recently by the Latin American and Caribbean Economic System (SELA) and which will serve as the basis for the meeting of “Experts on Public Debt Burden in Caribbean Countries”, scheduled to take place on February 24th 2014 at the headquarters of the Association of Caribbean States (ACS).

The Study addresses initially the situation of Latin America where, Latin American records, on average, and country by country, give no indication of an imminent debt crisis. However, during the period 1999 to 2011, which was covered by the aforementioned Study, the indicators of the public debt and external debt burden of Latin America have had a tendency to improve and are considerably lower than those in the Caribbean.

“Some economists have advocated borrowing to finance public investment, which has been referred to as the “golden rule” (Tanzi, 2011). This argument is based on the notion that “since public investment generates assets that favour future generations, the latter should pay for it. This argument makes the assumption that public investment is always productive” (Tanzi, 2011).

Although it is true that debt can be used as a tool for improving macroeconomic performance and promoting wellbeing, excessive borrowing can lead to an unsustainable fiscal situation, having a negative impact on macroeconomic stability and economic growth.

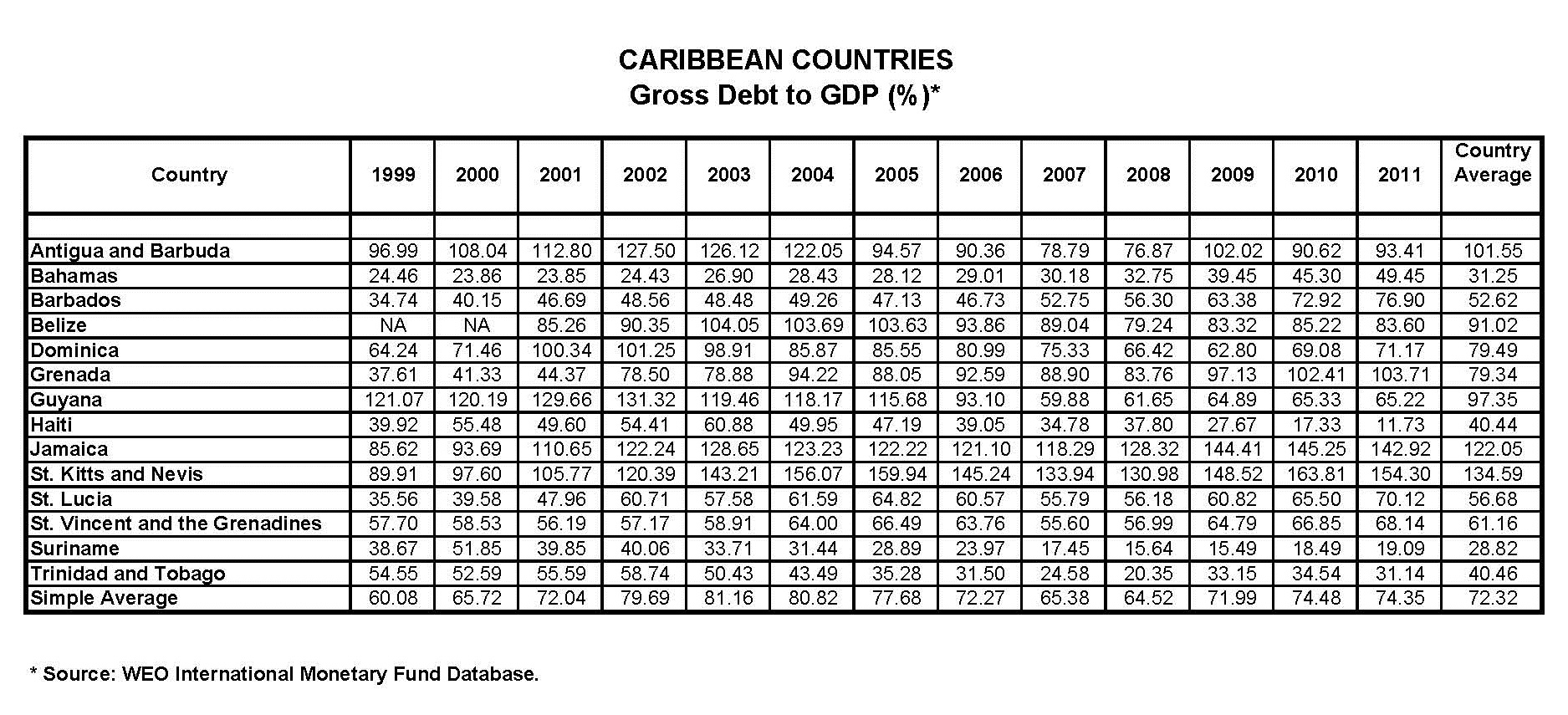

The analyses performed in the aforementioned study, based on the aggregate data on the Caribbean region, show clear signs of a situation involving excessive debt burden and potential fiscal insolvency. In 2011, ten of the fourteen countries whose gross public debt figures are available (IMF-Word Economic Outlook (WEO)) recorded debt-GDP Gross Domestic Product) ratios higher than the 60% threshold. In 2011, four showed debt-GDP ratios higher than 90% (Reinhart and Rogoff 2011 threshold). Of the eight countries on which data was gathered on external debt (World Bank –International Debt Statistics), four reported debt-GDP ratios higher than the Reinhart and Rogoff (2011) critical value of 60%, while seven presented external debt levels higher than 30%.

The simple average of the public debt-GDP ratio in the Caribbean (fourteen countries considered in the IMF-WEO) for the period 1999-2011 was recorded at 72.32% and in 2011 this indicator reached 74.35%. Meanwhile, the same average debt-GDP ratio of the Caribbean (1999-2011) has also remained higher than the value recorded for Latin America and the Caribbean as a whole (51.77%).

In using simple statistics and more elaborate econometric methods, the Study presented evidence that the public debt burden of Caribbean countries has a significant negative impact on economic growth.

The primary conclusion of the data analysis, in aggregate terms and country by country, is that a proper combination of fiscal consolidation and debt restructuring/relief is decisive in order to achieve a debt level that is compatible with fiscal sustainability in the Caribbean region.

Caribbean countries must strive to negotiate and obtain the highest level of debt restructuring/relief possible. However, the excessive debt in the majority of the nations in the region hinders the debt reduction required without fiscal adjustments.

The considerable magnitude of the fiscal effort necessary to achieve debt levels consistent with fiscal solvency, calls for the fiscal consolidation programmes in the Caribbean region to be carefully designed and implemented over several years. The authorities responsible for formulating policies need to be convinced that the current level of excessive debt in the region is severely restricting the use of the fiscal policy and is negatively affecting economic growth.

The ideas described above will be addressed at the meeting organised between both international organisations with the following objectives:

Analyse the external debt situation of Caribbean countries and the public policies that must be adopted to resolve them, focussing on different solutions that could respond to the specific characteristics of Caribbean economies.

Exchange experiences among the countries of this sub-region in particular, looking at solutions that should be adopted in order to lighten the burden on their respective economies.

Disseminate information on this reality between the countries of the region and the various integration organisations in Latin America and the Caribbean.

Identify debt relief policies, particularly measures to promote investment and stimulate economic growth.

Establish conclusions and recommendations for operational use by the countries affected, and provide strategic information for the other Member States.

The meeting will begin with the presentation of the concept document entitled “Debt Burden and Fiscal Sustainability in the Caribbean Region”, to be delivered by the SELA consultant-researcher, Víctor Olivo, followed by the national experiences of each country, presented by representatives of St. Kitts and Nevis, Jamaica, Grenada, Barbados and Guatemala.

It will later examine fiscal adjustment and economic growth from a regional perspective, with participants from CARICOM, Economic Commission for Latin America and the Caribbean (ECLAC) and the Organisation of Eastern Caribbean States (OECS), to then close with the same topic, but from the perspective of the multilateral organisations, such as the Latin American and Caribbean Economic System (SELA,) the Inter-American Development Bank (IDB), the World Bank, the International Monetary Fund (IMF) and the G24 Secretariat.

Alberto Durán Espaillat is the Director of Trade Development and External Economic Relations of the Association of Caribbean States (ACS). Any correspondence or feedback can be sent to [email protected]

Related Press Releases

Press Release - H.E. Ambassador Noemí Espinoza of Honduras Elected Secretary General of the Association of Caribbean States

Port of Spain, Trinidad and Tobago – November 7, 2024 –

ACS Secretary General of the ACS attends the PMAC 27th Annual General Meeting

ACS Secretary General Rodolfo Sabonge, attended the Port Management Association of the Caribbean

29th Ordinary Meeting of The ACS Ministerial Council concludes in Paramaribo, Suriname

The Association of Caribbean States (ACS) is an intergovernmental organization comprising 25 Memb